Today’s insurance operations are becoming increasingly complex, tech-powered, and demand greater speed and precision than ever before. As a response to these challenges, insurance Business Process Outsourcing actively keeps rising in popularity.

In this article, we’ll define Business Process Outsourcing for insurance companies considering partnering with an insurance BPO provider — benefits, scope of services, and beyond.

What Is Insurance BPO? Definition and Value

Insurance BPO outsourcing is a vital service provided to insurers seeking to remain competitive in an increasingly digital and cost-sensitive market.

So, what is BPO insurance partnership, and what makes it so efficient? Let’s explore.

BPO Insurance Meaning

Insurance BPO meaning implies the process of delegating routine or specialized insurance-related operations (both customer-centered and back-office ones) to an external service provider.

Insurance Business Process Outsourcing Benefits

Judging from numerous real-life cases and a thorough BPO cost analysis, one thing remains clear: insurance BPO unlocks real business value across multiple business areas.

By working with efficient, result-oriented insurance BPO providers, insurance companies are empowered to experience the following results:

- Lower operational expenses thanks to outsourcing resource-heavy tasks.

- Streamlined workflows to efficiently scale operations or match seasonal demands.

- Faster issue resolution and accelerated response time.

- Data-driven insights thanks to advanced technologies and reporting.

- Guaranteed global and regional compliance across multiple jurisdictions.

Real-Life Results from Insurance Operations Outsourcing Case Studies | ||

Handoffs reduced by 40% for a multi-line insurance company Cognizant | Cost reduction by 30% through automated claim management for a leading tech provider WNS | Improved debt recoveries by 25% for an Australian insurance provider |

BPO Insurance: Scope of Processes to Outsource

Claims Processing

As one of the core insurance Business Process Outsourcing services, an insurance BPO partner is dedicated to seamless insurance claims business process outsourcing activities. In doing so, a BPO partner ensures that claims are resolved swiftly and accurately. As a result, it can reduce turnaround times and minimize fraud exposure.

To support claim processing, top insurance BPO companies perform the following:

- Collect initial claim information from policyholders.

- Verify the submitted data to confirm the claim’s validity.

- Adjudicate the claim by assessing coverage details, liabilities, and payouts.

- Process the settlement and initiate payment to the claimant.

- Provide relevant updates to the policyholders.

Policy Administration and Servicing

Similar to the impact of HR business process outsourcing services, outsourcing policy administration ensures smooth, accurate updates, all while easing internal workload and maintaining consistency across the entire policy lifecycle.

As a part of this process, a BPO partner is responsible for the following actions:

- Setting up new policies based on approved applications and underwriting results.

- Managing renewals, endorsements, and modifications.

- Processing cancellations, terminations, and refunds.

- Handling document generation and storage for all policy-related records.

Underwriting Support

Insurance BPO is dedicated to accelerating underwriting through activities like reliable data collection, documentation, and risk insights.

This process looks as follows:

- The BPO provider gathers necessary data from internal systems and external databases.

- Conduct preliminary screening to assess basic eligibility and identify potential red flags.

- Prepares underwriting reports that summarize applicant risks and background details.

- Resolves any missing or unclear information for utmost accuracy.

Customer Service

Since many BPO providers have responsive, well-trained customer service teams, they often play a key role in helping insurers maintain consistent communication and foster high levels of customer satisfaction.

To ensure customer service efficiency, insurance BPO providers do the following:

- Respond to inquiries regarding policies, billing, renewals, and claims.

- Troubleshoot service issues and log complaints.

- Deliver customer support through dedicated channels.

- Capture and analyze feedback to improve service quality.

Regulatory Compliance and Reporting

Another essential responsibility of outsourced insurance services is compliance support — crucial for accurate reporting, audit readiness, and peace of mind.

With the scope of these BPO services for insurance, Business Process Outsourcing insurance providers regularly perform these tasks:

- Monitor legal and regulatory updates that may affect insurance operations.

- Maintain documentation for easy access to records.

- Submit reports to regulatory bodies.

- Assists with data accuracy checks during audits.

- Perform employee training or deliver information about regulatory changes.

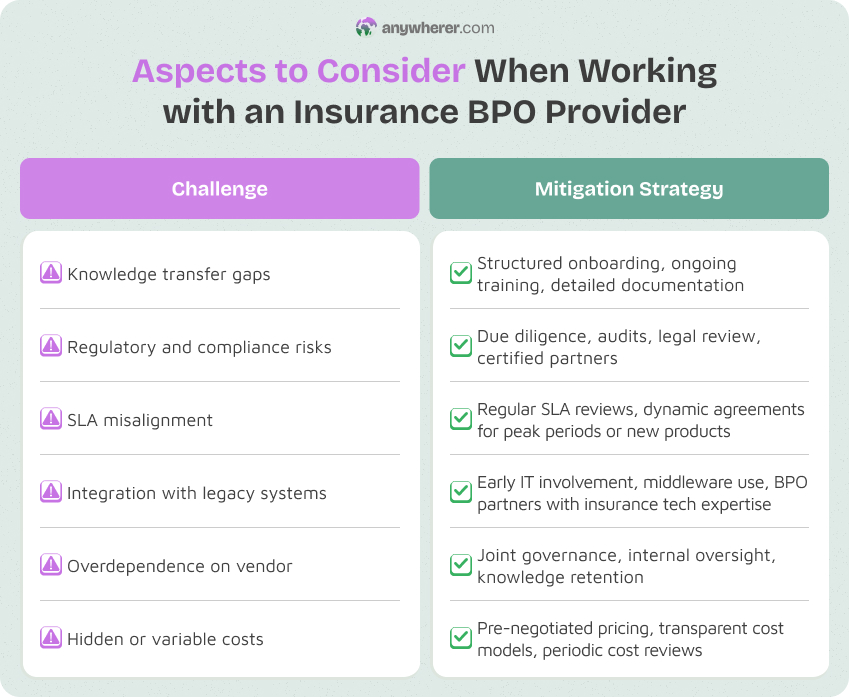

Insurance BPO Outsourcing Challenges

While life insurance BPO offers numerous benefits, involving an external vendor might introduce certain challenges. See some of them outlined below.

Challenge #1: Knowledge Transfer Gaps

Since insurance operations often involve complex products and region-specific regulations, the transition might be challenging. At this stage, knowledge gaps may arise — potentially leading to errors, delays, and inconsistent service quality.

Challenge #2: Regulatory and Compliance Risks

Insurance risk management BPO can be a double-edged sword. In practice, an outsourced process can prove itself highly efficient. However, without proper oversight and efficient partnership alignment, handing over compliance-sensitive functions could bring the risk of exposing the company to legal or reputational risks.

Challenge #3: SLAs Misalignment

Service level agreements may not always reflect evolving business needs — peak seasons, new insurance products, operational changes, you name it. This need to revisit the pre-agreed terms might have its consequences: additional costs, delayed service delivery, unmet performance targets, or even customer dissatisfaction from disrupted insurance BPO processes.

Final Thoughts on Insurance BPO

Wrapping up, outsourcing in insurance goes way beyond merely cutting costs anymore — it’s about staying efficient and competitive.

Therefore, whether you’re looking to automate claims, improve response times, or scale support fast, the right BPO health insurance partner can make a real difference. It’s all about finding the balance between control, collaboration, and capability.

FAQs on Insurance BPO Process

How does BPO insurance work?

As per the health insurance BPO process, insurers contract BPO firms to handle specific tasks. These firms use trained staff and tech platforms to manage operations efficiently while the insurer retains strategic control.

How much does insurance business process outsourcing typically cost?

In most cases, life insurance Business Process Outsourcing costs are usually customized based on factors like the scope of insurance BPO services, volume, process complexity, and region. Pricing may be hourly, per transaction, or fixed monthly, depending on the agreement.

How to choose the right insurance BPO provider?

First and foremost, look for the vendor with industry expertise, in-depth regulatory compliance knowledge, proven service quality, and efficiency in secure data handling. When doing so, ask for case studies and check tech compatibility.

Yaryna is our lead writer with over 8 years of experience in crafting clear, compelling, and insightful content. Specializing in global employment and EOR solutions, she simplifies complex concepts to help businesses expand their remote teams with confidence. With a strong background working alongside diverse product and software teams, Yaryna brings a tech-savvy perspective to her writing, delivering both in-depth analysis and valuable insights.