When it comes to handling HR, a lot of growing businesses reach a point where doing it all in-house just isn’t cutting it anymore. That’s when options like HRO (Human Resources Outsourcing) and PEO (Professional Employer Organization) start popping up. At first glance, they both help lighten the HR load, but they’re actually quite different in how they work and what they offer.

Whether you’re trying to streamline payroll, get better employee benefits, or make sure you’re staying on the right side of labor laws, understanding the distinction between the two models can help you figure out which one fits your business best. Let’s break down the PEO vs HRO differences.

HRO vs PEO: Breaking Down the Basics

If you’re trying to decide between an HRO and a PEO, it helps to get really clear on what each one actually does. This section walks you through the core purpose, main functions, and how each model works behind the scenes. Let’s start with the Professional Employer Organization definition.

PEO Model Overview

PEO Definition

A PEO acts as a co-employer, sharing legal responsibilities with your business. This means the PEO becomes your partner for tax and insurance purposes, while you continue managing the day-to-day operations and direction of your team.

Purpose of the PEO Model

PEO outsource HR without you needing to establish a local entity. With this model, you get access to a bundled set of services under one roof. And this can be helpful for small to mid-sized businesses and startups.

Its main purpose — reduce administrative burden and compliance risks by sharing the responsibilities of employment. A great fit for companies looking to simplify HR, offer competitive benefits, and expand across regions or countries without establishing local entities.

Core PEO Functions

Payroll Processing and Tax Filing

Employee Benefits Administration

Risk Management and Compliance

Global HR Support

Hiring and Onboarding Support

Immigration and Work Visa Guidance

What Influences the Cost of PEO

PEOs usually charge a percentage of the payroll. So, the cost of services will depend on factors like the number of employees, the selection of benefits you’re interested (type, region, and level of coverage), and also the country where you want to employ.

Though PEO services HR outsourcing may carry a higher price tag, it often includes broader compliance coverage, bundled benefits, and reduced risk exposure.

HR Outsourcing Model Overview

HRO Definition

An HRO is a third-party provider that helps businesses manage specific HR functions like payroll, recruitment, training, and compliance. It’s a flexible model where you choose which services to outsource while staying the legal employer of record.

Purpose of the HRO Model

So, what does HRO mean? It’s basically a contractor that offers customized HR support that scales with your business, without giving up control. Ideal for companies that want help with day-to-day HR tasks while maintaining authority over policies and employment decisions.

Core HRO Function

Payroll and Tax Processing

Employee Recruitment and Onboarding

Training and Development Programs

Benefits Administration via Third-Party Carriers

Performance Management

Labor Law and Compliance Guidance

What Influences the Cost of HRO

Compared to PEO outsource HR is more likely to come at a custom pricing since the cost depends on many factors. But they can also charge flat monthly fees, hourly rates, or per-employee-per-month (PEPM) — with flexibility to scale up or down based on your needs.

A few factors that influence the price include:

- Number and complexity of services chosen

- Size and location of the workforce

- Integration with your existing HR systems

- Level of customization or strategy involved

- Software platforms included

On the topic of costs, if you’re thinking of hiring an HR manager vs a PEO or HRO firm, you should factor in the expenses associated with in-house employees. This entails a monthly salary and benefits — in case one person can handle your scope of tasks.

At this point, we should also note that if you’re choosing between PEO vs ASO vs HRO, among PEO alternatives, ASO may seem similar, but it’s more about handling administrative functions. It is more similar to PEO, albeit handling employees under the client’s EIN.

The Differences Between HRO and PEO Explained in Detail

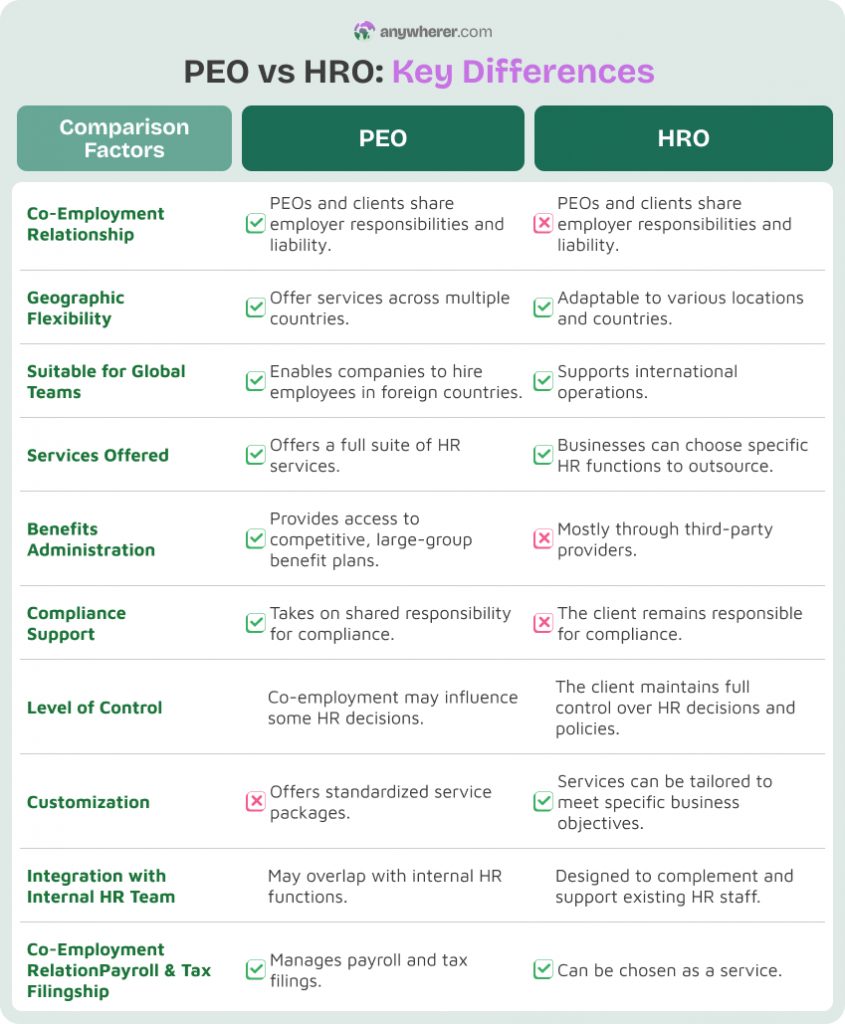

Employment Relationship & Liability

With a PEO, you enter into a co-employment arrangement where the PEO legally shares responsibility for your employees. It helps reduce your liability by absorbing some compliance risks.

PEO Employment Relationship: Key Takeaways

Legal Employer

Entity Requirement

Compliance Responsibility

Risk Management

Control Over Policies

Shared (co-employment)

May not need your own entity (for global hiring)

Shared with PEO

Actively manages and assumes some legal risk

Shared input, depending on agreement

In contrast, an HRO provides support without changing the employer-of-record status — you retain full control and legal accountability. HROs leave the legal responsibility entirely on your shoulders, though they do guide you through best practices.

HRO Employment Relationship: Key Takeaways

Legal Employer

Entity Requirement

Compliance Responsibility

Risk Management

Control Over Policies

Your business

You must have a legal entity

Employer (you)

Advisory only

Full control

Flexibility & Customization

PEOs provide bundled services in a more standardized format. While this makes setup easier, it limits your ability to fine-tune services. It’s more of an all-in-one solution that’s consistent across clients.

PEO Flexibility & Customization: Key Takeaways

Service Customization

Scalability

Internal HR Integration

Onboarding Process

Low to moderate — bundled packages

Scalable, but tied to bundled service

May replace or overlap internal HR

Streamlined but more standardized

HROs are modular by design. You can pick and choose only the HR services you need — from recruiting to compliance training — and customize the support based on your internal capabilities.

HRO Flexibility & Customization: Key Takeaways

Service Customization

Scalability

Internal HR Integration

Onboarding Process

High — select the scope of services

Very flexible — adjust as you grow

Complements existing HR team

Tailored setup process

Cost Structure

PEOs generally charge a percentage of the payroll or a monthly flat fee. Such packages include payroll, compliance, benefits management, and more.

PEO Cost Structure: Key Takeaways

Typical Pricing Model

Cost Flexibility

Budget Predictability

Access to Group Benefits

% of total payroll or a monthly flat fee

Moderate — bundled cost model

Tied to payroll fluctuations

Included — pooled buying power

HROs usually follow a fee-for-service model, charging flat rates, hourly fees, or per-employee-per-month (PEPM) costs depending on what you outsource. This allows for more precise budgeting — you only pay for what you use.

HRO Cost Structure: Key Takeaways

Typical Pricing Model

Cost Flexibility

Budget Predictability

Access to Group Benefits

Flat rate / hourly / PEPM

High — pay only for what you need

Easier to forecast

Usually separate / market rates

Global Hiring Potential

Global (or international) PEOs are great for companies hiring across borders. They act as the legal employer in other countries, allowing you to hire internationally without setting up local entities.

PEO Global Hiring Potential: Key Takeaways

Supports Global Hiring

Employer of Record

Ease of Global Expansion

International Compliance

Yes — no entity needed (via global PEO)

Global PEOs acts as employer of record

Fast setup with global PEOs — no entity setup required

Full compliance management

HROs are also global-friendly, but you must already have (or create) legal entities in each country where you want to hire. They’ll help manage HR operations, but they don’t provide the legal infrastructure that international PEOs do.

HRO Global Hiring Potential: Key Takeaways

Supports Global Hiring

Employer of Record

Ease of Global Expansion

International Compliance

Yes — with local entities

Your company (entity required)

Slower setup — requires registration

Advisory role

Benefits & Talent Retention

Access to competitive employee benefits can make or break your talent strategy. PEO HR outsourcing services often provide access to large-group insurance plans, retirement options, and other perks at lower costs — which is especially valuable for small businesses.

PEO Benefits & Talent Retention: Key Takeaways

Benefits Access

Plan Customization

Cost of Benefits

Employee Perks

Impact on Talent Retention

Pooled plans through PEO group rates

Limited to PEO’s offerings

Lower due to pooled buying power

Often included in service bundle

High — stronger benefits, streamlined HR

HROs can help administer benefits, but typically through third-party carriers and at market rates. They offer more flexibility in plan selection, but less purchasing power than a PEO model.

HRO Benefits & Talent Retention: Key Takeaways

Benefits Access

Plan Customization

Cost of Benefits

Employee Perks

Impact on Talent Retention

Via third parties

More freedom to choose carriers

Market rates

Depends on setup

Moderate — depends on external vendors

Quick Overview of PEO vs. HRO Providers

Now that we have covered the PEO HRO essential differences, here are some of the top HR outsourcing companies and top PEO firms.

Trusted PEO Partners in the Market

If you’re exploring Professional Employer Organizations to support HR, payroll, and compliance functions, this list highlights some of the most recognized and reliable names in the industry:

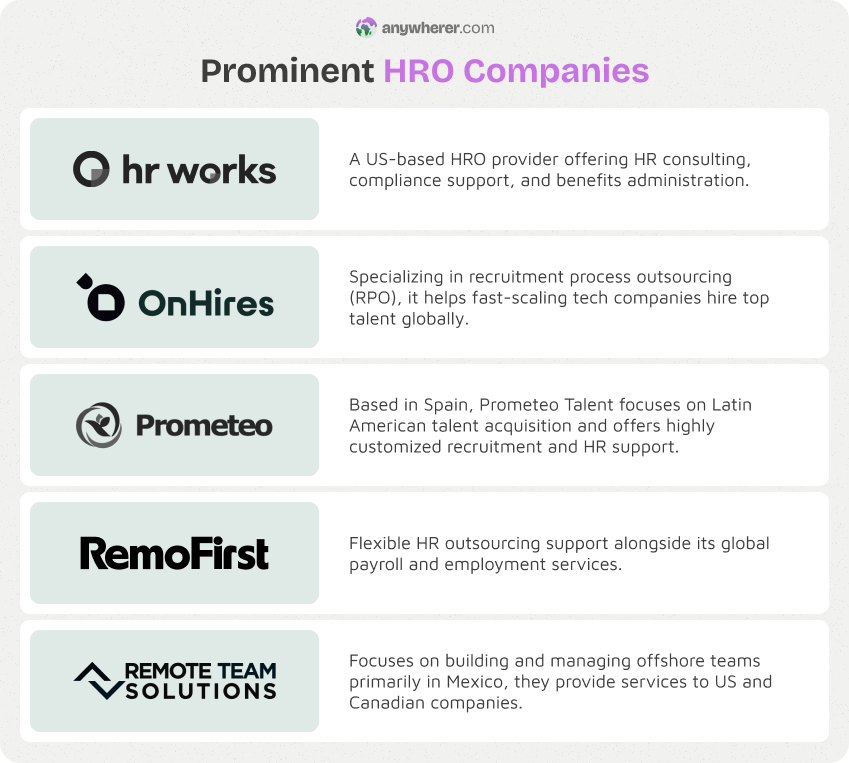

Trusted Names in Human Resource Outsourcing

Whether you’re looking to outsource payroll, benefits, or full-cycle HR services, these top HRO providers are known for their flexibility and proven results:

Wrapping It Up: Is a PEO or HRO Right for You?

The choice between a PEO and an HRO really comes down to how much support you need, and how much control you want to keep.

PEOs offer a hands-off experience, suitable for companies looking for a bundled, done-for-you approach to payroll, benefits, and compliance. On the other hand, HROs are best suited for businesses that already have an internal HR function or want to keep a tighter grip on policies and processes.

Whether you’re drawn to the convenience of a PEO or the flexibility of an HRO, it helps to understand where your business is today — and where it’s heading next. Both models have their strengths, and with the right partner, either one can be a smart move toward more efficient, scalable HR.

FAQs about PEO and HR Outsourcing

What is the main difference between a PEO and an HRO?

The biggest difference is the employment relationship. A PEO enters into a co-employment agreement with your business — meaning it shares employer responsibilities, especially around payroll taxes and compliance. An HRO provider, on the other hand, is simply a third-party vendor that you hire to handle specific HR tasks while you stay the sole legal employer.

Do PEOs and HROs offer the same HR services?

There’s definitely some HRO PEO overlap, but they’re not quite the same. Both can help with payroll, benefits administration, recruiting, and compliance support. But PEO HR services usually come bundled in a full-service package, including group benefits, workers’ comp, and tax filings. HROs are more flexible, letting you choose only the services you need.

Which model gives more control over HR decisions?

HROs give you more control — you’re still the sole employer, and you call the shots on policies, benefits, and hiring decisions. With a PEO, you share some employer responsibilities, which means certain decisions (especially around compliance and payroll) might be handled by the PEO.

How do costs typically compare between a PEO and HRO?

HROs are usually more customizable and potentially more cost-effective, especially if you only need help with a few HR functions. They often charge a flat fee or a per-employee-per-month rate. PEO services, in contrast, often charge a percentage of total payroll, since they’re taking on more legal and administrative responsibility. But keep in mind — a PEO may help you save on health insurance and compliance risks in the long run.

Can startups use an HRO, or is it better to start with a PEO?

Both can work for startups — it depends on what kind of support you need. If you’re a small team without an HR department and want turnkey HR outsourcing PEO might be ideal. You’ll get access to affordable benefits, tax filing, and built-in compliance support. But if you’re growing fast and just need scalable help with payroll, hiring, or onboarding, an HRO gives you more flexibility without locking you into a co-employment model.

Explore PEO vs HRO differences in depth and find the right fit for your team.

Yaryna is our lead writer with over 8 years of experience in crafting clear, compelling, and insightful content. Specializing in global employment and EOR solutions, she simplifies complex concepts to help businesses expand their remote teams with confidence. With a strong background working alongside diverse product and software teams, Yaryna brings a tech-savvy perspective to her writing, delivering both in-depth analysis and valuable insights.